Reconciling your bank transactions to your company book is essential to the financial health of your company. Nevertheless, if you’ve never ever reconciled your company’s deals before, the process can sound a bit challenging.

Keep reading to find the necessary actions in bank reconciliation and to see a number of examples of what a bank reconciliation might appear like.

1 QuickBooks Workers per Company Size Micro (0-49), Little (50-249)

, Medium(250-999), Large (1,000-4,999), Enterprise(5,000 +)Micro (0-49 Workers), Small( 50-249 Employees), Medium(250-999 Employees), Big(1,000-4,999 Staff Members )Micro, Small, Medium

, Big Features API, General Journal, Inventory Management

2 Acumatica Cloud ERP Employees per Business Size Micro (0-49), Little (50-249), Medium (250-999), Large (1,000-4

,999), Enterprise(5,000 +)Micro (0-49 Workers), Small (50-249 Staff Members), Medium (250-999 Employees), Large

( 1,000-4,999 Workers) Micro, Small, Medium, Large Features Accounts Receivable/Payable, API, Departmental Accounting, and more

What is bank reconciliation?

A bank reconciliation declaration compares a company’s checking account balance to the balance on its accounting records. A bank reconciliation will show any disparities between the two accounts. Bank reconciliation assists companies detect both accidental mistakes and intentional scams.

Why is bank reconciliation important?

Bank reconciliation advantages companies in numerous ways. Firstly, the bank reconciliation procedure will assist you discover and repair mistakes in your books. It will also help you identify fraud, wrongful payments, excess charges and other inappropriate payments that are costing your organization money.

Bank reconciliation also helps you stay on top of the monetary health of your organization. The bank reconciliation process allows you to track your company’ profitability with time. You will have the ability to classify tax-deductible expenses as you go through your records, helping you get tax breaks and guaranteeing you’re all set to submit taxes.

Kinds of bank reconciliation

In addition to completing an overall bank reconciliation, you may likewise want to do a reconciliation for just particular sort of transactions. Here are 5 types of bank reconciliation that every entrepreneur ought to understand:

Supplier reconciliation

Supplier reconciliation assists you find any differences between payments to providers and the general ledger. It includes comparing declarations from vendors to the transactions on the general ledger to ensure the total balance is precise.

Client reconciliation

If you let customers buy your products or services on credit, then you’ll need to carry out a client reconciliation. During this process, consumer transactions made on credit are compared to the accounts receivable journal along with the receivables control account, which becomes part of the general journal.

Charge card reconciliation

In contrast to consumer reconciliation, credit card reconciliation involves purchases your own service has made on credit. During this procedure, you will compare deals made on company charge card to invoices and cost reporting to make sure all purchases are accounted for and that no costs go unsettled.

Cash reconciliation

Services with retail places will require to conduct a cash reconciliation at the end of each work day. In a money reconciliation, cashiers confirm that the amount of money remaining in the register compares with the deals carried out that day.

Balance sheet reconciliation

Balance sheet reconciliation verifies that all of a business’s financial declarations are precise. Throughout this process, the balances on the balance sheet are compared versus the general journal as well as other supporting documents like bank statements and billings.

How to do a bank reconciliation

Gather your documents

To conduct a bank reconciliation, you will require your bank records for a set amount of time, usually the past month. You can access this information by describing your last banking statement or logging into your online organization bank accounting.

Some accounting apps will also immediately import your banking deals, speeding up the reconciliation procedure. You will also require access to your company books for that exact same amount of time, whether that’s in a spreadsheet, logbook or accounting software application.

Compare your books and savings account

Once you have actually got all your files together, compare your books to your bank declarations to identify disparities. For instance, you may have logged a payment to a supplier in your books, but that payment might not have really strike your savings account yet. Create a list of all the disparities and attempt to identify the cause of each.

Change the books and savings account

As soon as you have actually got a master list of inconsistencies, you require to add your missing out on book deals to your bank account and your missing bank transactions to your books. Ensure all withdrawals and deposits are represented during the period you’re fixing up.

Compare the adjusted balances

As soon as you’ve made all the required additions and subtractions, it’s time to compare the book balance to the bank balance. If you’re done your computations right, these 2 numbers must be exact and equivalent, and you’ll have finished with the bank reconciliation procedure.

Proper mistakes if needed

Common accounting errors will affect a bank reconciliation. Some regular mistakes to look out for consist of data entry mistakes, omissions mistakes, transposition mistakes, deceitful deals and an inaccurate beginning cash balance. Likewise, watch out for service charge you have actually forgotten to represent.

More payroll protection

Examples of bank reconciliation

Easy bank reconciliation example

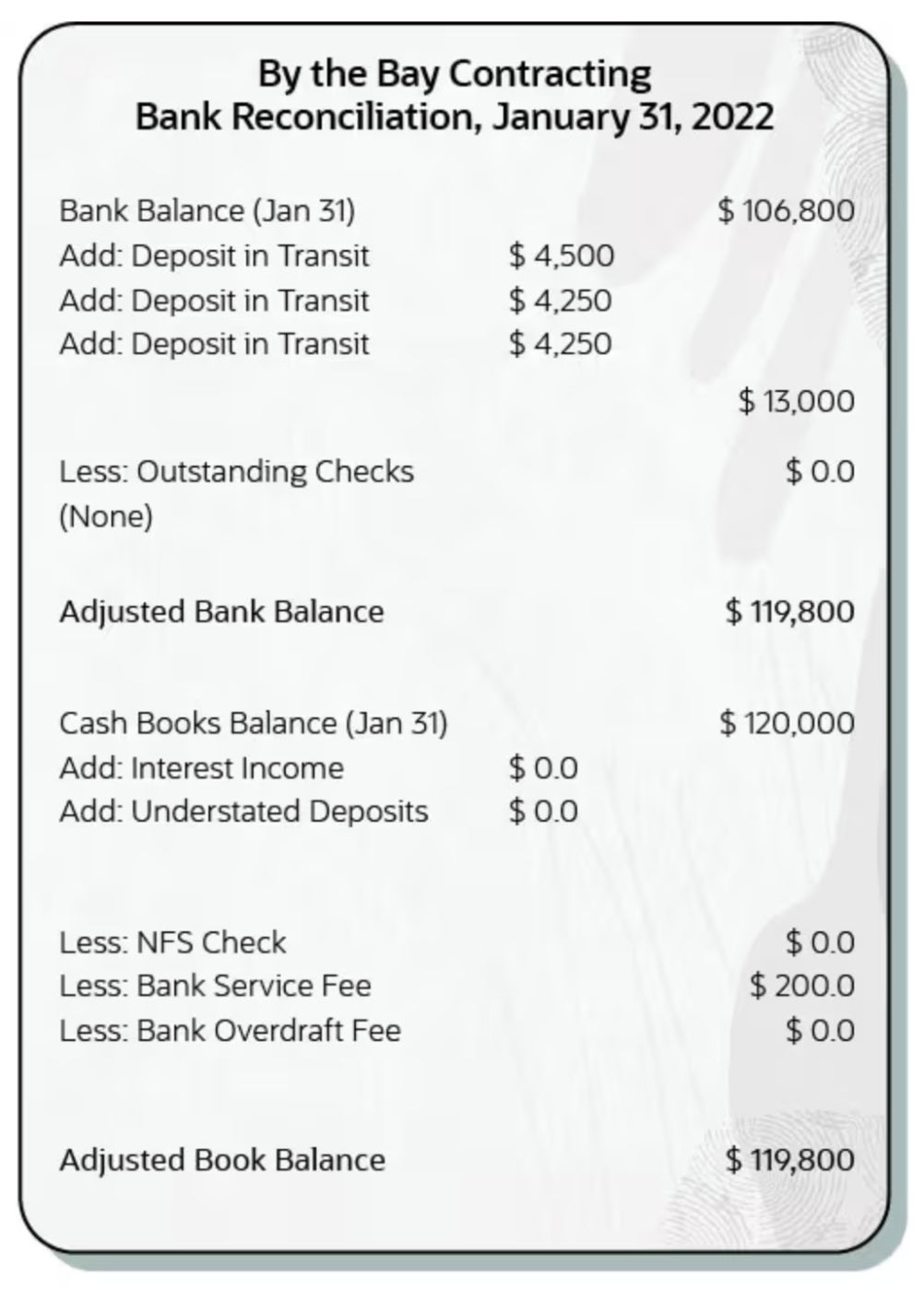

Our very first bank reconciliation comes thanks to NetSuite, an business accounting software application, and features a mock business called By the Bay Contracting. As you can see in this easy example, the company requires to add $13,000 in overall to its bank balance and deduct $200 in charges from its books to make whatever balance out.

An example

An example

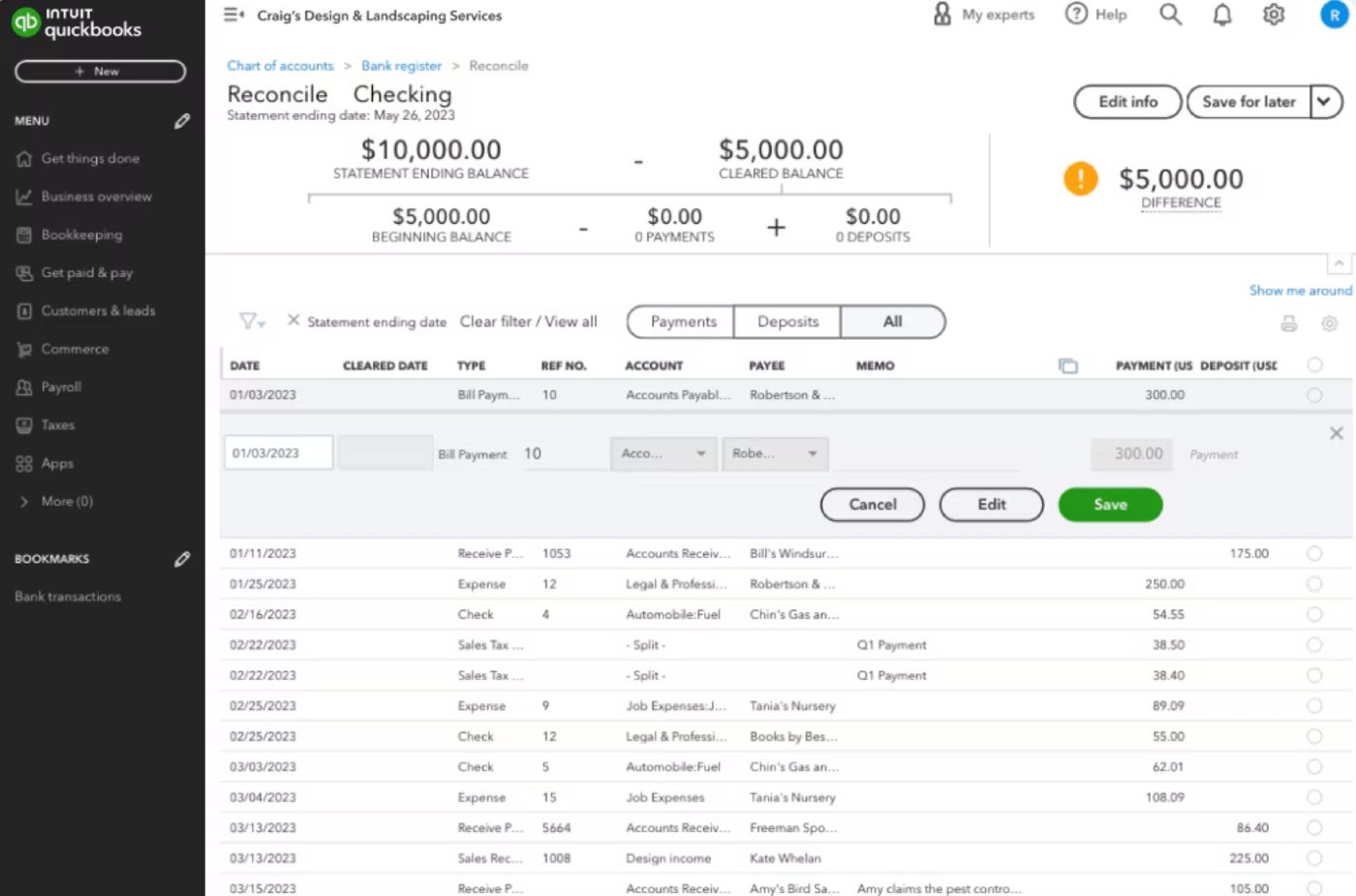

of bank reconciliation in NetSuite. Image: NetSuite Complex bank reconciliation example Our next example shows a more complicated bank reconciliation in QuickBooks. As you can see, there is a$5,000 disparity between the statement-ending balance and the cleared balance for Drag’s Design and Landscaping Providers. Business owner needs to add all outstanding payments and deposits until the 2 balances match up.

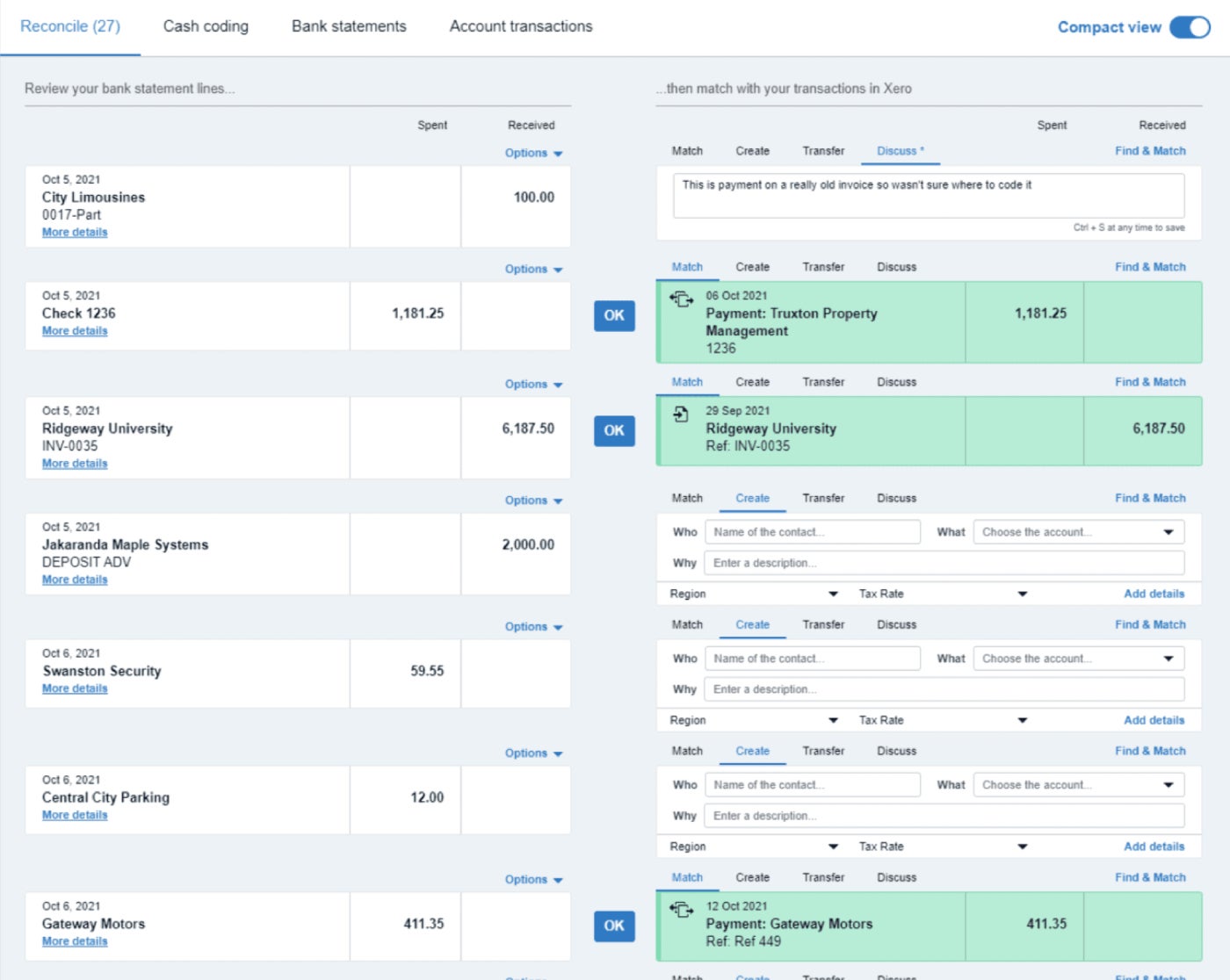

An example of bank reconciliation in QuickBooks. Image: QuickBooks Bank reconciliation software example Our last bank reconciliation example shows how a software like Xero can import and classify bank transactions to speed up bank reconciliation. As seen in the example, the accounting software automatically matches bank declaration links to documented transactions in Xero and prompts you to add unrecorded bank transactions to your books.

An example of bank reconciliation in Xero. Image: Xero Common bank reconciliation concerns What is the significance of bank reconciliation?

An example of bank reconciliation in Xero. Image: Xero Common bank reconciliation concerns What is the significance of bank reconciliation?

Bank reconciliation is the procedure of comparing a business’s checking account balance to the balance on its accounting records to validate that all transactions have actually been represented.

What is one function of bank reconciliation?

The function of a bank reconciliation is to review all deals that have been taped on your bank statements and books. Producing bank reconciliations assists identify unrecorded transactions and fraudulent or incorrect charges.

What are the 4 actions in bank reconciliation?

After gathering your files, the 4 primary actions of bank reconciliation are comparing your books and bank declarations, changing the books and bank to correct inconsistencies, comparing the adjusted balances to each other and repairing any remaining mistakes if needed.

What is an example of bank reconciliation?

If a company’s bank declarations show that it has $10,000 in cash, but the books only reveal that they have $9,000, then the company must perform reconciliation to identify the missing out on $1,000 in deposits.